Promptly contact your bank should you find any fraudulent transactions. Identify fraud: Review your statements regularly to help spot fraudulent activity, like someone using your debit card.

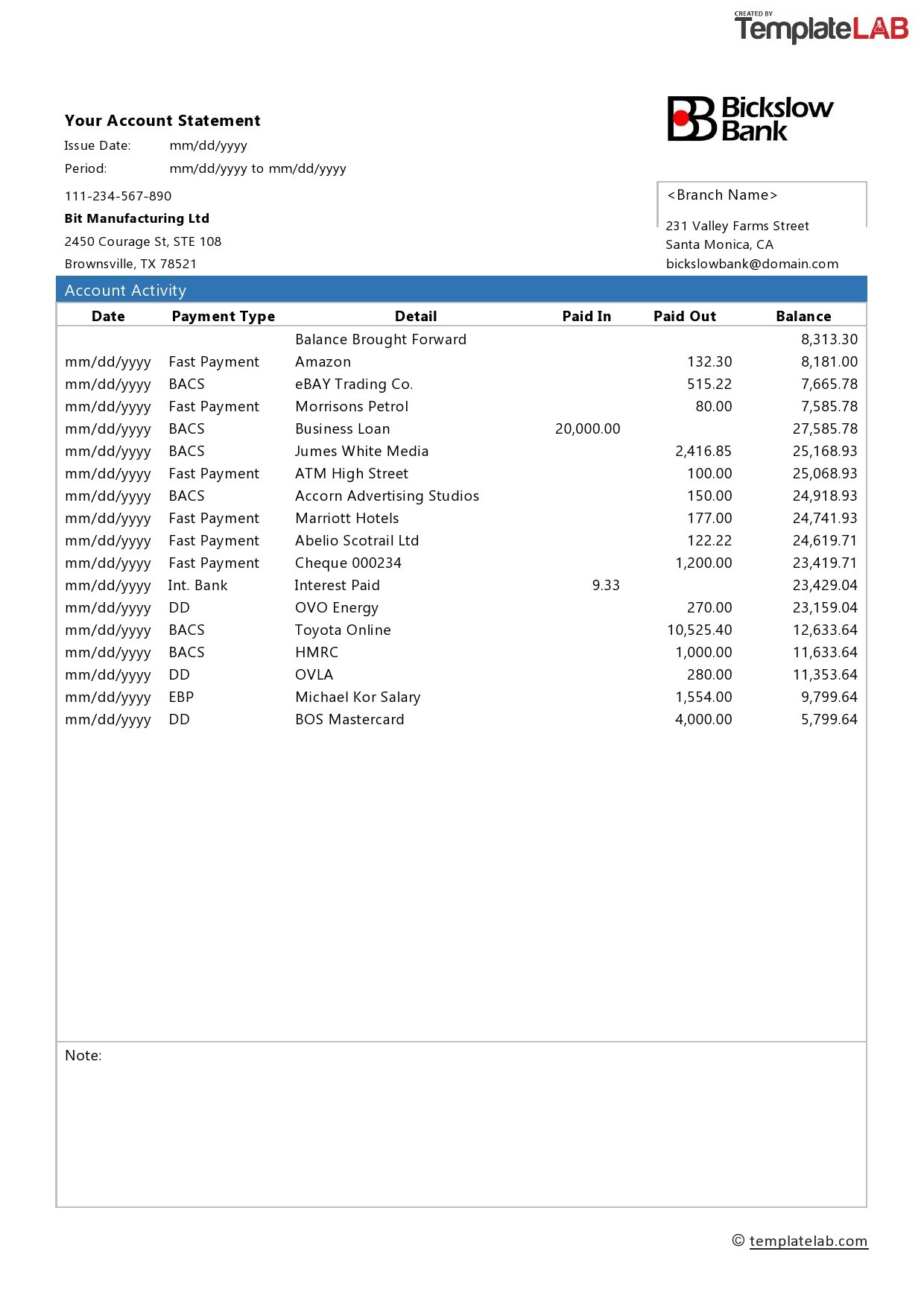

Monitor your account balance: Reduce overdraft fees by ensuring you always have enough to pay for bills and ATM transactions. Depending on what interest you earn, you may want to put some of your money in an investment account or money market to earn more. See how much interest you’re earning: If your bank or credit union gives you interest, see how much money it’s making you every month. Take note of how much you’re accumulating. Track your savings: Look at your beginning and ending balances over the course of a month or a quarter. Gauge your spending: Review your bank statement monthly to keep a tab on your expenses. Here are the main things you can do with a bank statement: From monitoring your spending to catching errors, bank statements are an easy-to-use financial tool.

#CREATE FAKE BANK STATEMENT ONLINE PDF#

Use PDF Reader Pro to sign it, add a date, print out the form and send it to your clients if necessary.īank statements come in handy for a variety of reasons. Save the complete form so you can retrieve it from anywhere in the future;Ĥ. Click on any field and start typing your information ģ.

#CREATE FAKE BANK STATEMENT ONLINE INSTALL#

Install the free trial of PDF Reader Pro, open your sample bank statement in PDF Reader Pro Ģ. That’s why you have to be careful when you receive one, and you should make sure that it’s not a fake bank statement.įill out a form with PDF Reader Pro can b e an easy thing, please follow the following steps to create your bank statement:ġ. Sometimes, you can even use the document as your proof of address.Ī bank statement is very important. This is because banks typically utilize bank statements to advertise their plans, products, and financial schemes. Through this simple document, you will also learn about different types of bank schemes. It will also allow you to plan your expenses accordingly.Īfter you’ve confirmed the balance in your account through a bank statement template, you can issue checks as payment for things you purchase. The document can be very helpful to make yourself aware of your financial status. It’s your account, so you have the right to know all of these details. They also contain specific amounts which you have paid or received within a given period. One major purpose of bank statements is to provide you with information about how much funds remain in your account.

The start date of the statement period is usually the day after the end of the previous statement period. Such statements are prepared by the financial institution, are numbered and indicate the period covered by the statement, and may contain other relevant information for the account type, such as how much is payable by a certain date. A bank statement is an official summary of financial transactions occurring within a given period for each bank account held by a person or business with a financial institution.

0 kommentar(er)

0 kommentar(er)